Subsidized Loans: Importance, Current Status and Challenges

Background

Those loans where the Government of Nepal will be (has been) providing subside (subsidies) on interest, where concerned Banks and Financial Institutions can add a maximum of 2 percent on their base rate are explained to be subsidized (loans). In such loans, Banks and Financial Institutions are not allowed to take anything except interest rate, Credit Information Charge, Insurance Premium, and Credit Security charges. This type of loan is a support that is being provided to a limited mass from those literate youths who want to be empowered, those female entrepreneurs, those youths who want to start venture after being back from abroad to a few other groups as explained by the working procedure issued by Nepal Rastra Bank.

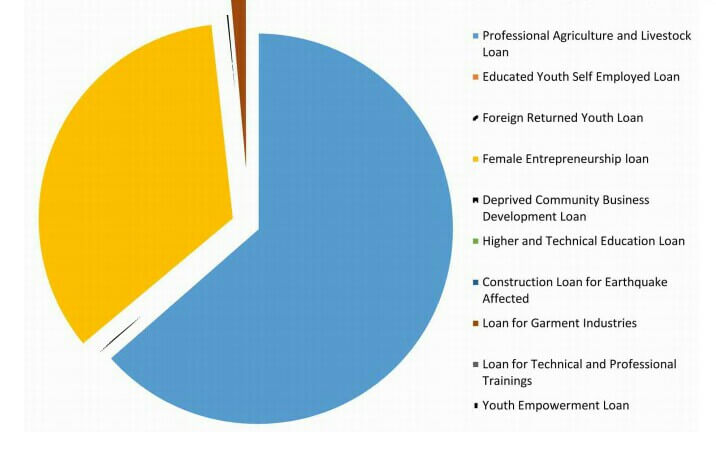

To foster innovation and growth in these firms, governments address financing constraints by initiating public support programs (Hottenrott., et al, 2017). The core intention of this type of loan is to empower the target group through financial support that they can work out. Subsidized loan, where the interest will be subsidized by Government has been categorized into following divisions as per the guideline issued by Nepal Rastra Bank:

- Professional Agriculture and Livestock Loan

- Educated Youth Self Employed Loan

- Foreign Returned Youth Loan

- Female Entrepreneurship loan

- Deprived Community Business Development Loan

- Higher and Technical Education Loan

- Construction Loan for Earthquake Affected

- Loan for Garment Industries

- Loan for Technical and Professional Trainings

- Youth Empowerment Loan

Current Status

Currently, it seems the total loan that is being provided under Subsidy is Rs 14,001,062.82 (Chaitra 2078). There has been the maximum level of professional agriculture and livestock loan that has been granted till date which is followed by female entrepreneurship loans. The table and chart below make it clear. The data about accepted loans has been presented here.

| Nature of Loan | Accepted |

| Professional Agriculture and Livestock Loan | 162190074 |

| Educated Youth Self Employed Loan | 78149 |

| Foreign Returned Youth Loan | 782796 |

| Female Entrepreneurship loan | 87641885 |

| Deprived Community Business Development Loan | 767814 |

| Higher and Technical Education Loan | 46802 |

| Construction Loan for Earthquake Affected | 62430 |

| Loan for Garment Industries | 3564234 |

| Loan for Technical and Professional Trainings | 400 |

| Youth Empowerment Loan | 11100 |

| Total | 255145684 |

The number of applicants is rising every single day, and people are interested in this type of loan. But there lies a major problem regarding the fact that such loans are being compiled not approved or are undergoing hectic processes as well. The proportion of loans for educated youth, for youth empowerment, or technical and professional training seems to be below, but the level of inquiry of such loans is increasing every single day with a growing level of financial literacy there itself. The biggest threat is that people are being self-centered and preparing their dummy status for obtaining such a loan in any possible way that they can – registering a firm just for the sake of the loan too.

Importance

There is a greater set of advantages that this type of loan yields. They are not just loans, but a booster to the entire economy as well as a great space for the promoter. It is generally provided to reduce the burden and is often considered to be within the overall interest of the public which is granted for the promotion of a better society or enhancing a good social and economical upliftment. At a time when economists have been feeling that such subsidies impact-free the market and unnecessarily distort the market by preventing efficient outcomes by diverting resources through productive uses it somewhere helps in allowing improvisation as a whole too. Following are the major advantages that these subsidized loans assure:

- Optimum utilization of Youth Bulge: While checking global history, the developed nations caught the pace when youths bulge took the space within them. It is that tenure of the era in any nation when the youth population turns out to be maximum. These loans are directed at preventing brain drain and making the best utilization of them within the nation.

- Financial Assistance for Youth Empowerment: Youths get empowered when they get the right direction and contribute to the national economy from every possible set of efforts that they can work out. These loans aim to the empowerment of youths through financial assistance in various sectors where youths can excel themselves – from agriculture to modern entrepreneurship.

- Relief Packages for those affected: As a responsibility of the nation or state, when in pain, it turns out to be their liability to look after the people. So, seeing the earthquake scenario, the subsidized loans that are being offered is a big relief package. It helped them to bounce back and get to normal life through building procedures.

- Promotes Independence: When individuals don’t have to rely on any relatives or neighbors and can obtain a loan through legitimate means, without the assistance of any other person; independency gets promoted for those who desire to work on their own. They can design their pattern and way of working there itself and will be solely liable and responsible for various aspects there itself.

- Supports Economy: The economic booster here will be supported from every possible angle and layer. There has been some sort of basic regard that the economy would be boosted when individual citizens get employed and turn out to be independent. It just does not boost the GDP of the nation but brings further job opportunities too.

Major Obstacles

Although there have been several provisions made compulsion for providing subsidy-based loan by Banks and Financial institution, the expectation level, and reality seems to be under huge variance. People seeking such loans still have huge complaints about the obstacles that they face at the time of acquiring such loans. There is also a complaint from banking personnel for the same – explaining why such loans have not been into their preference, clearly meaning that there lies some sort of obstacles or hindrances among them. Following are the major reasons why such loans are not obtaining hype as was expected in the Nepalese context.

- Lack of Awareness: The target group for whom this type of loan was focused, tends to remain out of its knowledge. Because they are not so aware, they don’t tend to make use of it – and rather depend on other sources for their fund accumulation like Dhukuti, Money Lenders, or expensive interest-based financial institutions. Now since banks and financial institutions don’t promote such loans – a large bunch tends to be out of the knowledge itself regarding their existence.

- Diversified Intention: Money can be used for anything – the same amount can be used for building a house, purchasing land, organizing an event, or investing in some productive sector. This type of intention-based aspect here does have some crucial role to play. When the applicant applies for the loan, their intention would be as per the regulation; but on obtaining the money they change their intention and use it for some other purpose because of which the core intention has not been achieved.

- Complex Procedure: The complex nature that such subsidized loan incurs, for which one should prepare a business plan, register the firm to bring the person for a guarantee all act as an obstacle for the applicant. Apart, they should timely present audit reports too. On the other side, what makes this task further complex is banks do hesitate in granting such loans as it is not as profitable as other ones and checking the character of the applicant is somewhere complex. Ultimately, providing a loan without collateral all comes under the bank’s risk here creating a major obstacle here.

- Not hitting the target: Often such loans are taken by a person making use of someone else’s name. What it appears here is that the loan under ‘women entrepreneurship’ is often utilized by her husband, and such things appear. It has been found that the target person whom the policy was drafted is actually out of its access and there is someone else who has been making use of this type of fund here which certainly counts as one major barrier here.

- Additional Hidden Cost: There then lies some additional cost that appears within the side. Although the policy directs that there should not be an additional cost, be it for the cost of insurance premium, preparation of project analysis report, or payment of credit security charges – the applicant seems to be not interested. This somewhere does play some major role in discouraging such type of loan on one aspect or the next. The worst thing there is that this type of loan can be obtained only for a specific time.

- Lack of Promotion: The way how Home Loan is being promoted, or in the manner regarding how Auto Loan gets coverage – such loan remains within the shadow as they are never prioritized by the Bank and Financial Institutions. As a result, the demand for such loans would automatically go lower, not leading to the charm of such type of subsidized loan. Had there been enough promotions, people borrowing from other sectors would easily diversify and shift their loans towards the subsidy-based loan.

Conclusion

The subsidized loan has been a requirement of the nation. Youths who would want to do something – be that cattle rearing, farming, or any entrepreneurial work should be somewhere linked and associated with financial access. Fong, et al (2020) explains that all entrepreneurs especially the new entrepreneurs who are yet experienced in the business field, will have the tendency to face various challenges on their road to success in this field. Capital has been the basic capacity and essential that is required for the initiation, or there should be some financial back support for smooth operation. The subsidized interest rate on debt does not create any additional cash flow and all the changes in values and the cost of capital are the result of the redistribution of cash flows among debt, equity, and government, and subsequent reduction in financial risk due to lower leverage (Ibragimov, et al 2006). When Government itself is concerned and focused, where Banks and Financial Institutions have been complying with such basic requirements through their optimum level of effort, what can be easily tracked or guided here has to be considered. The minimum requirements set by Central Bank to disburse the loan in such fields has been compelling banks to provide such subsidized loan too. But, there should be careful monitoring of not just disbursement but usage too. For those mortgage-free loans, there are pressures and are later found not to be utilized properly too. Chances of turning into a bad loan are high, for which banks should be alert too. This form of lending must be necessary, but there has to be a strong mechanism to regulate its operation too. Are they being effective – someone should at least be able to analyze their impact from the corner point that they had been working around. Only then the impact of such loans can be tracked and analyzed, and their effectiveness would turn out to be meaningful. Else, they would simply be the loan – given for the sake of giving – without any strong, measurable or expected impact.

References

- Drucker, P. (2005). Innovation and Entrepreneurship: Practice and Principles. Butterworth-Heinemann. Repr.

- Fong, Eng & Jabor, Khata & Zulkifli, Abdul & Hashim, Mohamad. (2020). Challenges Faced by New Entrepreneurs and Suggestions How to Overcome Them. 10.2991/assehr.k.200921.037.

- Gretzel, U., Fesenmaier, D. R., Formica, S., and OʼLeary, J. T. (2006). Searching for the Future: Challenges Faced by Destination Marketing Organizations. Journal of Travel Research. 45(2), 116-126.

- Hottenrott, Hanna & Lins, Elmar & Lutz, Eva. (2017). Public subsidies and new ventures’ use of bank loans. Economics of Innovation and New Technology. 1-23. 10.1080/10438599.2017.1408200.

- Ibragimov, Rauf & Velez-Pareja, Ignacio. (2006). Subsidized Loan Financing and its Impact on the Cost of Capital and Levered Firm Value – A Non-Technical Reply to ‘Adjustment of the WACC With Subsidized Debt in the Presence of Corporate Taxes: The N-Period Case’. SSRN Electronic Journal. 10.2139/ssrn.928048.