Introduction:

Financial sector reforms are the activities or initiatives taken by the government and central bank to make financial sector more efficient, inclusive and risk resilient. It is continuous process implemented in order to improve the quality of financial services and the functioning of financial system

Introduction:

Financial sector reforms are the activities or initiatives taken by the government and central bank to make financial sector more efficient, inclusive and risk resilient. It is continuous process implemented in order to improve the quality of financial services and the functioning of financial system

पृष्ठभूमी

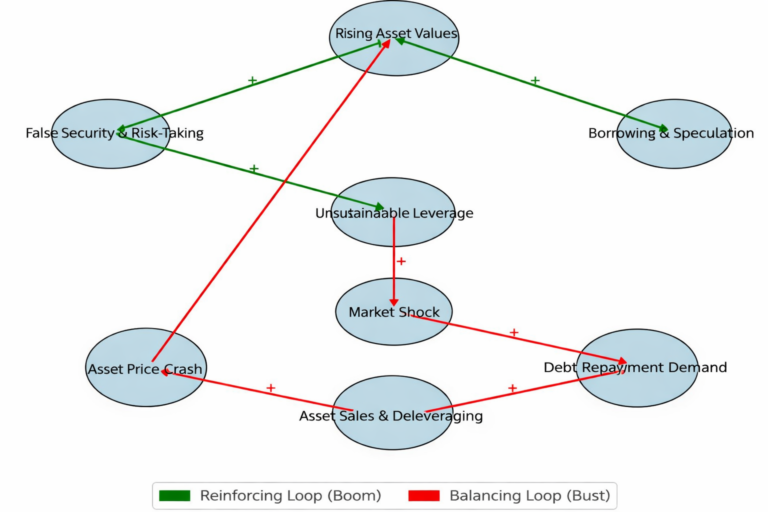

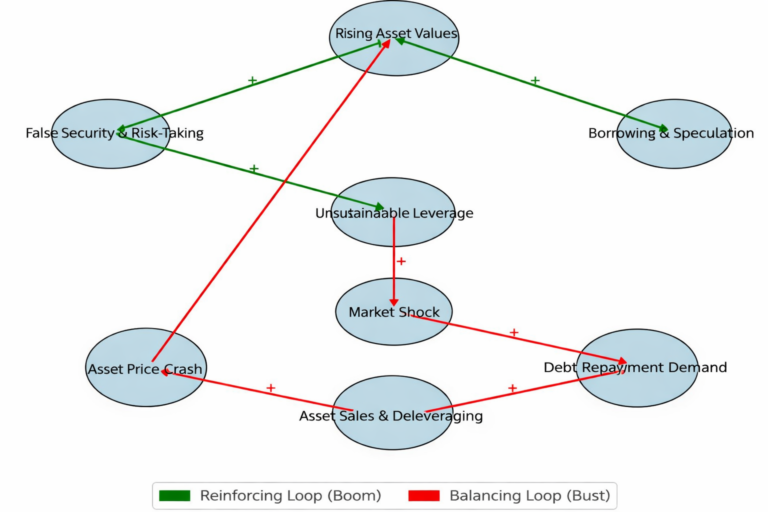

जसरी मौद्रिक नीति सम्वन्धी छलफलहरुमा व्याजदरको वहसले प्राथमिकता पाउने गरेको छ, कर्जा विस्तारको चर्चाले कम महत्व पाएको देखिन्छ । तर, सन १९३० को महामन्दी र त्यसपछिका विभिन्न घटनाक्रमहरुलाई समेत नियाल्ने हो भने कर्जा प्रवाह र वित्तीय स्थायित्वमा यस्को प्रभावका सम्वन्धमा थप स्पष्ट हुन्छ । यद्दयपी,

पृष्ठभूमी

जसरी मौद्रिक नीति सम्वन्धी छलफलहरुमा व्याजदरको वहसले प्राथमिकता पाउने गरेको छ, कर्जा विस्तारको चर्चाले कम महत्व पाएको देखिन्छ । तर, सन १९३० को महामन्दी र त्यसपछिका विभिन्न घटनाक्रमहरुलाई समेत नियाल्ने हो भने कर्जा प्रवाह र वित्तीय स्थायित्वमा यस्को प्रभावका सम्वन्धमा थप स्पष्ट हुन्छ । यद्दयपी,

The situation with the economy of Nepal seems worse. But still, there is some chance for improvement. Putting aside, rather weighing more, the internal political instability, the COVID-19 pandemic, its aftermath, and the Russia-Ukraine, Israel-Hamas conflict made it very difficult for the Nepalese economy to

The situation with the economy of Nepal seems worse. But still, there is some chance for improvement. Putting aside, rather weighing more, the internal political instability, the COVID-19 pandemic, its aftermath, and the Russia-Ukraine, Israel-Hamas conflict made it very difficult for the Nepalese economy to

Concepts

Financial innovation is defined as the emergence, diffusion, and popularization of new financial instruments, as well as new financial technologies, institutions, and markets. In other words, financial innovation refers to the process of creating new financial or investment products, services, or processes. These advances include

Concepts

Financial innovation is defined as the emergence, diffusion, and popularization of new financial instruments, as well as new financial technologies, institutions, and markets. In other words, financial innovation refers to the process of creating new financial or investment products, services, or processes. These advances include

Abstract

Nepal's banking industry plays a vital role in supporting its developing economy. For years, it's been run through a centralized system led by the Nepal Rastra Bank (NRB), which oversees regulations, monitoring, and monetary strategies. This approach has had some real wins, like ensuring stability

Abstract

Nepal's banking industry plays a vital role in supporting its developing economy. For years, it's been run through a centralized system led by the Nepal Rastra Bank (NRB), which oversees regulations, monitoring, and monetary strategies. This approach has had some real wins, like ensuring stability

विषय सार

नेपालजस्तो विकासशील मुलुकहरूको आर्थिक र सामाजिक विकासका लागि आन्तरिक स्रोतहरू मात्र पर्याप्त नहुने हुँदा वैदेशिक लगानी आर्थिक रूपान्तरणको महत्वपूर्ण माध्यमका रूपमा रहन्छ । वैदेशिक लगानी भन्नाले कुनै विदेशी कम्पनी, संस्था वा व्यक्तिले अर्को देशमा उद्योग, उत्पादन, सेवा वा परियोजनामा पूँजी लगानी गरी दीर्घकालीन लाभ

विषय सार

नेपालजस्तो विकासशील मुलुकहरूको आर्थिक र सामाजिक विकासका लागि आन्तरिक स्रोतहरू मात्र पर्याप्त नहुने हुँदा वैदेशिक लगानी आर्थिक रूपान्तरणको महत्वपूर्ण माध्यमका रूपमा रहन्छ । वैदेशिक लगानी भन्नाले कुनै विदेशी कम्पनी, संस्था वा व्यक्तिले अर्को देशमा उद्योग, उत्पादन, सेवा वा परियोजनामा पूँजी लगानी गरी दीर्घकालीन लाभ

Abstract

The integration of Artificial Intelligence (AI) and Machine Learning (ML) in the Nepalese financial sector is a transformative development that offers numerous opportunities to enhance financial inclusion, optimize decision-making, and improve operational efficiency. However, its adoption faces challenges such as data quality, regulatory frameworks, and

Abstract

The integration of Artificial Intelligence (AI) and Machine Learning (ML) in the Nepalese financial sector is a transformative development that offers numerous opportunities to enhance financial inclusion, optimize decision-making, and improve operational efficiency. However, its adoption faces challenges such as data quality, regulatory frameworks, and

Abstract

Due to its implications for energy conservation and the avoided economic costs, households' underinvestment in energy-efficient technologies continue to be a major concern for policymakers. The reception of energy-efficient machines, durables and technologies by an economic agent offers both energy preservation and financial benefits. Refrigerators,

Abstract

Due to its implications for energy conservation and the avoided economic costs, households' underinvestment in energy-efficient technologies continue to be a major concern for policymakers. The reception of energy-efficient machines, durables and technologies by an economic agent offers both energy preservation and financial benefits. Refrigerators,

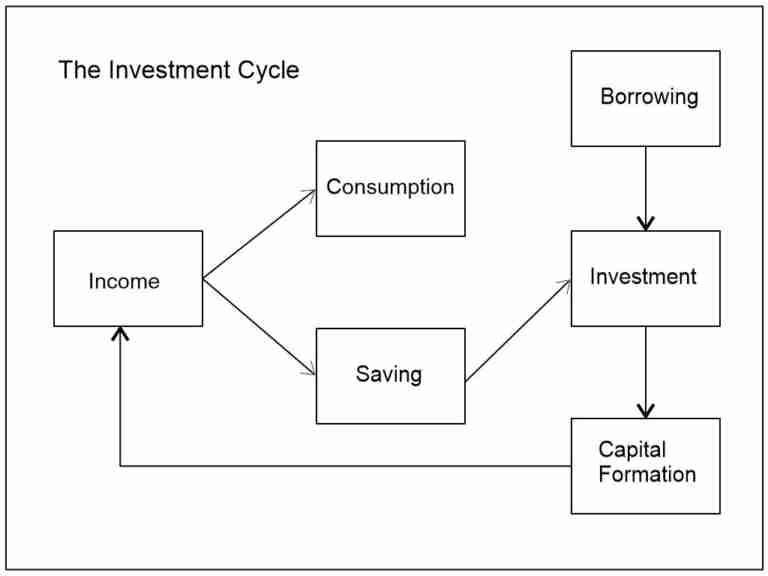

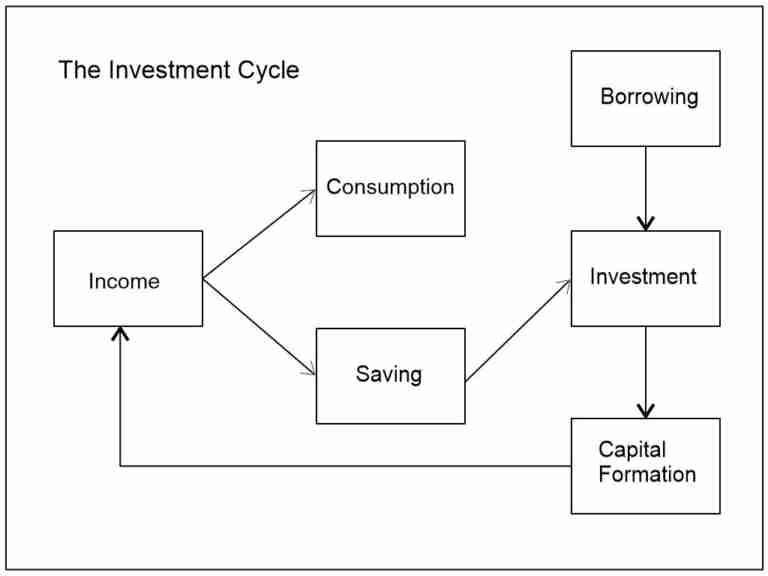

Investment is one of the vast topics in personal as well as corporate finance. Investment decisions of a person or an institution are made with rigorous analysis of returns, risks, tax implications, trends in the market, etc. Many deep concepts of economics, psychology and statistics

Investment is one of the vast topics in personal as well as corporate finance. Investment decisions of a person or an institution are made with rigorous analysis of returns, risks, tax implications, trends in the market, etc. Many deep concepts of economics, psychology and statistics

Project financing constitute a significant portion of loan investments of banks. Because of large outlays, noteworthy time lag between commitment of funds and generation of cash flows to serve the bank liabilities and irreversibility of the venture, project financing proposals are often subject to a

Project financing constitute a significant portion of loan investments of banks. Because of large outlays, noteworthy time lag between commitment of funds and generation of cash flows to serve the bank liabilities and irreversibility of the venture, project financing proposals are often subject to a

Introduction:

Financial sector reforms are the activities or initiatives taken by the government and central bank to make financial sector more efficient, inclusive and risk resilient. It is continuous process implemented in order to improve the quality of financial services and the functioning of financial system

Introduction:

Financial sector reforms are the activities or initiatives taken by the government and central bank to make financial sector more efficient, inclusive and risk resilient. It is continuous process implemented in order to improve the quality of financial services and the functioning of financial system