Management of Investments

Investment is one of the vast topics in personal as well as corporate finance. Investment decisions of a person or an institution are made with rigorous analysis of returns, risks, tax implications, trends in the market, etc. Many deep concepts of economics, psychology and statistics come to collide in the realm of investment management. Here in this article it is attempted to share the ideas of investment management in non technical and non executive language as far as possible.

Investment as an economic activity refers to putting resources into the instruments that entail returns in the future. Being oriented to the future, it inherently carries the element of risk besides the expectations of returns which incite for the sacrifice of consumption at present. The management of investments personal or institutional, has the risk and returns as the major considerations while the other ones include time horizons, cost, convenience, etc. Here in this article it is attempted to discuss the issues in the management of investments.

Investment: The General Concept

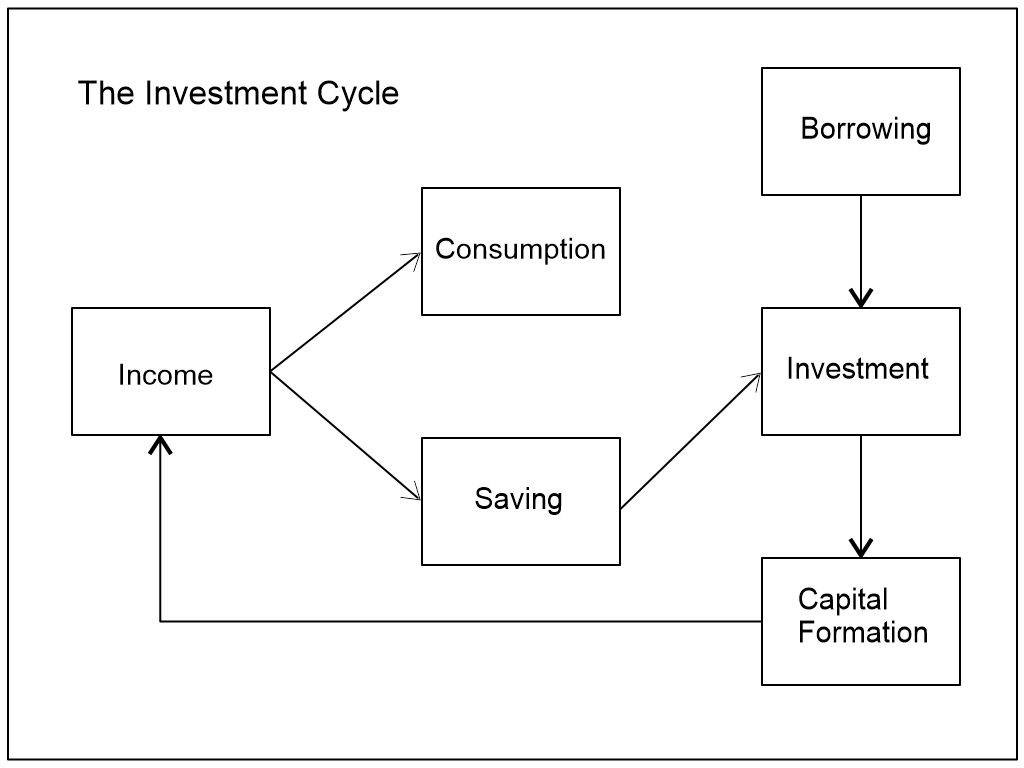

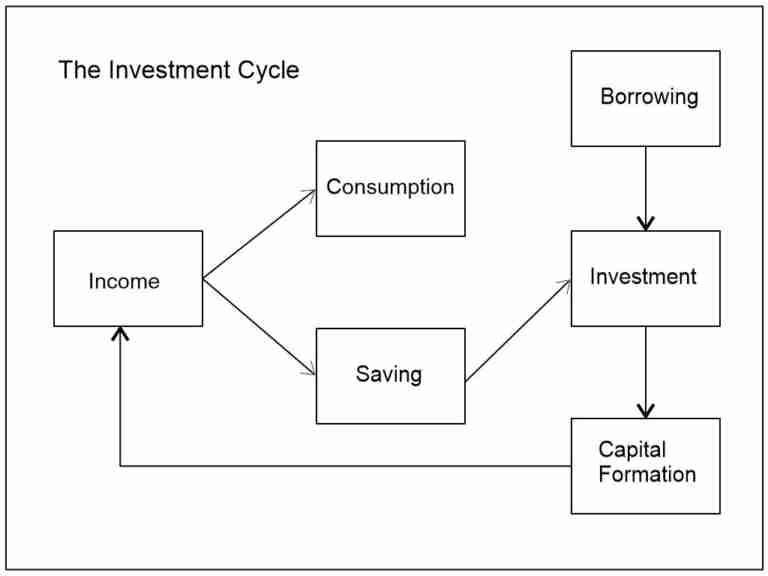

It is most logical to start from income. Income is bifurcated into consumption and saving. Some of

the income is spent on consumption – food, living, education, etc. while the rest is saved. This saving can be subjected into investment. Besides, elegant investors can also borrow from others and invest. Investments provide the means for further production and generation of higher income again. In this way there operates an investment cycle. The same has been displayed in the diagram below.

Returns and Risks

People can make investment in a wide range of instruments. They include real assets like land, buildings; financial instruments like shares, certificates of deposits, corporate or government securities, options, futures, insurance policies; precious metals like gold, silvers, diamonds or even the collectibles like precious specimens of paintings, metal or stone crafts, etc. All in common, investments carry the expectations of returns. Be the case of real or financial investments, an investor looks at the prospect of returns in lieu of the consumption postponed. Before deciding to buy a cow, it is quite natural that one likes to know how much and how long in the future it can give milk. Before purchasing a farmland, one likes to know how many kilograms or quintals of grains can be produced from it each year. In purchasing precious metals like gold and silver which do not have any periodic returns by themselves, expectation of price on resale of the same in the future becomes the concern. Naturally, the more the expected returns, the more is the tendency of a rational investor to invest on the asset.

The next element is the risk. An investor is worried of how certain are the streams of income or price appreciation of the asset. The less the variability of the returns, the better is the investment. In all analysis of investment strategies and choices, rationality of investor is the central assumption. Combining the two attributes return and risk, the preference of an investor lies in an instrument that has the highest possible rate of return on an investment given a level of risk he/she is willing to assume. Put the other way, it may be the minimum level of risk on a certain level of return. Out of the numerous investment alternatives, a rational investor can choose one that is the most attractive in terms of both risk (minimal risk) and return (maximum). What is mostly done is that the maximum level of risk to be borne is determined first and investor tries to select securities and make a best combination of securities to form the portfolio to maximize the return within the chosen level of risk.

Besides the risk and return, there are some more aspects investors generally look into. One is the liquidity. This means how conveniently, quickly and cheaply (in terms of transaction costs) an investment can be converted into cash when needed. Better liquidity makes an investment more attractive to the investor. The next is the time horizon of the investor. That means for how long the investor can deploy the funds. The matching of the investment horizon of the investor with the life of the instrument determines its desirability. If a person needs significant sum of money for college education of his/her children in one year, instruments of investment having longer term returns become less desirable to him/her. The risk taking attitude of an investor can also vary according to the age and career stage. A person at his early career and with aspirations to grow can take higher risks than one at mid career when he has to take care of the aged parents or growing children. Still different risk attitude can be found in one who is in late career stage and planning to retire in few years. Similarly, a person more devoted in security trading can involve in a more active trading and frequently reshuffle the investments taking more risks than one in passive trading strategy.

Diversification: A Mantra in Investment

Different investment alternatives vary in their risk and return characteristics. Compared to each other, the tendencies of the returns on two different investments can be similar or opposite. One can vary the same way or the opposite way with the other. While some variations arise due to overall economic turns boosting or impeding the returns on all, while some variations arise with industry specific and firm specific reasons. As the old maxim “Do not put all eggs in one basket” suggests, it is not appropriate to invest all the money in one or similar instruments. Diversifying the investment in two or more different investment instruments in general, reduces the overall risk as it is less likely that all of them will fall into loss in the same time. However, investing across the assets of negatively correlated return streams is better.

People deliberately or not, form combinations in their investments. We can invest some of our money in purchasing a land, some in gold, some in publicly traded equity shares; some in short term treasury bills, some in insurance policies, while some may be held in the form of cash or bank deposits. The combination or mix of assets formed by investing in different assets is called a portfolio. Portfolio management means the deliberate formation of a portfolio and its management with some objectives of growth and stability of returns. Choice of assets to form a diversified portfolio so requires study and analysis of the streams of returns with different assets, variability in comparison to the overall market tendency and the risk-return preferences of the investor. Based on the level of analysis and forethought employed, diversification can be naïve diversification, Markowitz diversification and superfluous diversification. Simple or naïve diversification means allocating the investment across different types and sectors of securities without rigorous analysis; just maintaining that it is better to diversify than to concentrate the investments. Markowitz diversification, named after Harry Markowitz, means diversifying the investments across the securities that have return tendencies negatively correlated to each other. However, trying to diversify the investment into too many assets generally, more than ten can turn superfluous as the increased costs of information and analysis can hardly offset the benefits of diversification.

Fundamental and Technical Analysis

Both logical as well as psychological reasons cause the price of the securities vary in the market. Fundamental analysis refers to the analysis of the market price, earnings, dividends, growth, etc. to find the real or intrinsic value of the security. Based on this value, a rational investor identifies underpriced securities to buy and overpriced ones to sell. Technical analysis is to study the trend of the prices and analysis of the charts, graphs, etc. to learn the mood of the investors in the market and potential price movements in the future. Based on the analysis, an investor has to choose what securities to buy, what proportion of investment to deploy across the different types of securities and when and which ones to

sell. In terms of investment strategies, investors can be active or passive. Active strategy requires much time and energy in more frequently buying and selling different securities across different sectors. This is to attempt for returns superior to the overall market returns. In passive strategy, investor does not try to outperform the market; he/she forms a portfolio and maintains it unless there is enough change in the market price and risk-return position to motivate for its revision.

Final Remarks

Besides just a trading activity, security trading is an interesting experience too. While institutional investors have a well defined investment policy with some ground rules regarding the amount of investment, risks to be borne, allocation across the types of securities, etc., individual investors are

moved more with the sentiments of greed and fear. They are affected by the recent past incidents of gains and losses. Wrong information and whims can sway the motivation to buy or sell. Differences in terms of investment objectives, risk taking and more importantly, the access to information work much in security trading. Investment consultancy services can contribute to the development of a more informed and educated trading of securities. Abundance of the different types of securities can offer wider range of choices a rational investor can play with. Expansion of market across a wider geographical coverage can bring in more and more people to the market net. Efficient systems for settlement and payments can expedite the financial circulation in the economy. So in a nutshell, a well developed market and a more educated exercise of investors can lead to the path of progress and prosperity through better management of investment at the individual as well as institutional levels.