Rising NPA: Factors and Causes

Background

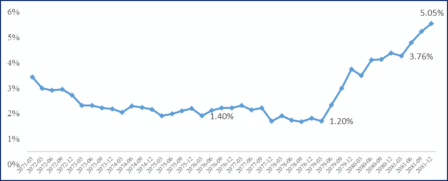

In the third quarter report, Nepal’s commercial banks showed a profit of a total of 41.25 in the area. While some banks made a profit of -91.91%, some made it to 2032.94% in comparison to the past year. Just in the third quarter, some banks made a total profit of 5.05 arba all alone too. Even the banks earning the lowest profit in the third quarter were reported to be 15.68 crores. This certainly is a huge sum while seeing the business industry of Nepal.

Falgun’s loans and advances this year are 5,463,766 million, whereas those of last year at the same time were 5,440,702 million—which is just 0.41% less than at the same time last year (NRB Report, 2025). This clearly indicates that loans and advances have not gone higher in comparison to the past year, giving a clear hint that businesses have not gone higher.

On the contrary, there is the next issue that has been emerging lately i.e. Rising NPA. A rising NPA means that the number or the amount of Non-Performing Assets (NPA) in banks is increasing. Breaking it down, NPA refers to loans and advances that borrower holds but for which they are not repaying interests or principal for a certain period (Adesina and Muteba, 2021). It has also been understood as a bad loan. And, the rise of NPA means that an increasing number of borrowers are not paying back (defaulting) their loans.

In today’s time large number of banks are found to be struggling to maintain asset quality and have been working to highlight the whole set of requirements for more strategic and sustainable efforts for controlling and minimizing NPAs in larger ways. Management of NPAs turns out to be a critical concern for the banking industry and can erode a whole bank’s profitability is necessary for sustainable economic growth – basically in developing economies like Nepal.

Factors leading to incremental NPA

Although banks and financial institutions don’t want to increase NPA, they take place all around. This is because when NPAs increase, banks do face a direct hit upon their profitability as they have to set aside more provisions for covering up potential losses, reducing the amount that would be available for lending and investment. It weakens the whole bank’s balance sheets and erodes shareholder’s confidence as well resulting in lower market valuation. Hence, banks do want to lower their NPA rate (Kalaivani and Vaithiyanathan, 2023). However, there are a different set of factors that leads to increasing NPA in reality which are explained as under:

Economic Slowdown:

At the time when the whole economy of the country slows down, it is for justified reason that companies earn less profit. In such cases, the consumer spends less, and different businesses shrink down or close down. So, if businesses are not earning enough, they fail to repay the loans. In such cases, individuals would also lose their jobs and would miss out on their EMIs. Like, for example during the COVID-19 pandemic time, global and Indian economies slowed down sharply and in that case, tourism, hotel, aviation, and retail businesses were all shut down. Loans granted to such businesses turned out to be a form of NPAs.

Sector-Specific Issues:

It has to be accepted that some sectors naturally hold a higher set of risks where problems like dropping of prices, overcapacity, or regulatory hurdles with commodity price crashes would cause or impact whole sectors for defaulting loans. Steel and infrastructures from 2010 to 2015 faced major problems when steel prices crashed down in the whole international market. There, infrastructure projects also happened to be delayed because of their land acquisition seeking environmental clearances. During that time, Bhushan Steel had to default on huge loans that caused NPAs for different banks. As of now, academic institutions seem to be having higher risk because of a lack of students.

Global Events:

Different global events could directly hit the economy. Events like oil shocks, wars, financial crises, or pandemics would reduce demand, increase uncertainty, or disrupt supply chains in its way. This would weaken companies’ financial position while they tend to be domestically strong. Russia Russia-Ukraine war led to massive increment in oil, gas, and fertilizer prices and companies related to those sectors had to struggle with higher costs with worsening loan repayment capacity that created pressure upon banks’ assets quality.

Natural Calamities:

Natural disasters, which are completely unpredictable like floods, droughts, and earthquakes that destroy assets – factories, houses crops, and other income sources lead to the situation when the loan customer won’t be able to pay back their loan. Basically in agriculture-dependent geographies, such calamities completely wipe out the whole farmer’s ability to repayment of loans. Like, in the Kerela floods of 2018, thousands of farmers lost their crops and capital and agriculture loans did affect farmers throughout Kerela leading to increased NPAs as they could not repay in time. The same happened during the 2072’s earthquake in Nepal.

Policy-based changes:

When the government makes changes to its policies, business approvals might get delayed, and business plans may fail which would result in lowering the capacity for repayment of loans. In 2012-13’s time, India’s Supreme Court canceled 214 coal block allocations because of a coal scam. These power and steel companies who borrowed heavily to set up plants there had to lose access because of cheaper coal and this also resulted in massive defaults of loans.

Political Influences:

Political pressures that banks face act as the next reason to wave down the loan. This would reduce the whole culture of repayment too. When the government of India announced INR 72,000 worth of loan waiver scheme, farmers at larger bunch expected that futures loans would be waived. Their repayment discipline broke down which resulted in incremental NPAs. Currently, some individuals are provoking mass with a consultation that banks should waive loans, creating expectations among mass – which could impact the whole NPA process too.

Causes of increasing NPAs

Causes are the outcomes of a bank or borrower’s direct failure that would affect any particular loan directly. Banks keep on struggling to maintain their asset quality with major highlights of needs for seeing strategic and sustained efforts (Selvarajan, 2013). The following are the major causes of NPAs in the banking industry:

Poor Credit Appraisal:

If banks fail to make proper assessments for repaying before giving a loan, if they don’t check the whole set of financial history, cash flows, project viability, or marketing condition – they might end up leading to risky borrowers. This will automatically increase the chances for NPA. During 2003-2008, when Indian banks aggressively gave infrastructure loans without full due diligence, many projects failed and loans turned to NPA.

Power Game:

Some borrowers decide not to repay their loans by making use of political influence, legal loopholes, or through fraudulent practices. For example, Vijay Mallya, though he had enough assets and international business defaulted on loans worth around 9000 crores, and Banks had to classify such loans as NPAs there.

Over Leveraging:

At different times, borrowers borrow more than they can actually repay, holding high level of confidence upon their growth in future. If business environment changes, their expected revenue might not turn out real and hence they become unable to pay the debt. Even when business underperform, companies will fial to repay back the loans resulting into NPAs.

Weak Monitoring:

If banks fail to monitor their loan clients about whether or not sales are happening, whether or not profits are there as per expectations, whether or not the cash flow is strong enough, whether or not the objective of the loan is met – problems might occur at any time and it might be too late to fix it. Failure to keep an eye on their loan client might result in such a situation.

Weak Recovery Practices:

When a borrower defaults, banks should be able to recover in more quick manner. Else, it will all worsen the whole losses. Through slow courts, long bankruptcy processees and weaker enforcement, banks would stay stuck with bad loans. From black listing to other aspects, the whole defaults can create impact.

Conclusion

It is no surprise that minimizing a bank’s NPA would require a certain proactive and multi-pronged set of approaches. There, combining a strong credit-based appraisal system with continuous borrower monitoring and timely restructuring of stressed assets and robust recovery mechanisms has to be promoted. There should also be strong risk management practices which would ultimately enhance staff training that would leverage technology for early warning systems. With the feeling of fostering a disciplined credit culture, the implementation of strategies in a consistent manner can also be worked out. Banks can come together to maintain the whole asset’s quality for protecting profitability and ensuring long-term financial stability as well.

Integration of technology, data analytics, and customer relationship management does have an important role to play in the process, and hence by consistently applying such strategies banks can work for the reduction of NPAs, and work to improve their financial resilience with a strong set of contribution to effectively manage their whole economic growth as well (Zala and Heenaba, 2014) .

In the context of Nepal, where real estate, hydropower, and small and medium enterprises have been dominating lending portfolios, banks should be vigilant enough. Strengthening borrower assessment, promoting financial literacy among clients, and improving coordination with regulatory bodies turn out to be something crucial. Here, for the growth of economic modernization, the reduction of NPAs will not just ensure stability but will contribute in a significant manner to the broader financial system’s strength and their sustainable national development.

References

Adesina, S., & Muteba Mwamba, J. W. (2021). Bank risk-taking behavior in Africa: The influence of net stable funding ratio. The Journal of Developing Areas, 55(1), 162–179. https://doi.org/10.1353/jda.2021.0042

Kalaivani, B., & Vaithiyanathan, B. (2023). A study on NPA governing efficiency of public sector banks.

Selvarajan, B. (2013). A study on management of non-performing assets in priority sector reference to Indian Bank and public sector banks (PSBs). Global Journal of Management and Business Research: C Finance, 13(1). https://globaljournals.org/GJMBR_Volume13/1-A-Study-on-Management-of-Non-Performing-Assets.pdf

Zala, H., & Heenaba, Z. (2014). Comparative analysis of impact of NPAs on profitability of selected public and private bank centres in India [Doctoral dissertation, Saurashtra University]. Shodhganga. http://hdl.handle.net/10603/31179