Emerging Challenges of Nepalese Banking Sector

Context and Background

Banking sector plays a crucial role in economic development of a nation. The banking sector of Nepal has played a vital role in promoting financial inclusion, economic growth, industrialization and investment over the past decades. With the expansion of financial institutions and technological advancement the Nepalese banking industry has experienced rapid growth but this growth has also brought several emerging challenges. In recent years, this sector has faced increasing pressure from global economic uncertainty, digital transformation and regulatory reforms. Nepalese financial institutions are pressured by the increasing cost of capital, low-interest rates, and evolving customer expectations. They must innovate and adapt to meet shareholder expectations and remain profitable. Despite that digitalization is transforming banking services and controls, offering significant potential benefits but also exposing institutions to evolving risks like fraud, consumer protection issues, and system disruptions. To stay competitive, banks must balance innovation with effective risk management. The Nepalese banking industry faces increasing challenges from cybercriminals targeting sensitive data and financial assets. Understanding cyber threats in the banking industry is crucial for effective security. The banking business is a type of trust based business that not only earn profits but also bears significant responsibility towards nation’s economic stability. Any problem that arises in baking sector affects entire economic system, making the banking sector highly sensitive and risk prone.

In modern age influenced by globalization and liberalization, the Nepalese banking system has undergone significant transformation. The challenges in its journey toward sustainable economic growth and development. Nepalese banks today must not only deal with financial management but also address issues related to good governance, risk management and sustainable development while maintaining liquidity, profitability, stability and efficiency. Therefore, the banking business is increasingly complex and exposed to various types of risks. The Nepal Rastra Bank’s continuous efforts toward maintaining stability and ensuring good governance highlight the need to address these emerging challenges effectively. Brief discussion about major challenges of Nepalese banking sector has been presented as following.

1.Decreasing rate of return on equity

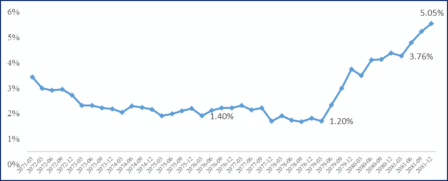

As we know return from invest in banking sector has been deteriorating over the years. Since banks are over capitalized due to merger and acquisition primarily. But business of banks has not been increased in proportion of uplift in paid up capital. To meet expectations of its investors now banks management and BOD is trying to expand business by hook or crook as results quality of banking assets have been degrading and profitability of banks and financial institution even sinking further. According to NRB’s Financial Stability Report 2024, the average return on assets (ROA) of commercial banks declined to 0.87%, while non-performing loans rose to 5.05% as on mid-April 2025. Additionally, Return on Equity (ROE) dropped below 9.67% in FY 2023/24 from 17.71% in mid-July 2018, a sharp increase from pre-COVID levels putting further pressure on net interest margins.

2.Financial crimes through digital banking

After the COVID-19 pandemic, the use of digital transaction has increased significantly in Nepal, leading to a proportional rise in financial crimes. According to the data published by Nepal Rastra Bank, there are currently around 1.92 crore mobile banking users in Nepal. Many fraud incidents are being reported through various digital communication platforms. According to Nepal Police’s Cyber Bureau, in the fiscal year 080/81 there were 4141 cases of online fraud conducted through digital platforms, a number much higher compared to the previous fiscal year. From a social perspective, people today are using various online banking system like mobile banking, internet banking and digital wallets among others. However cyber criminals have started misusing these systems. They deceive customers through fake calls, SMS, Messenger, Whatsapp, Viber and social media platforms, obtaining their personal details like username, password and PIN numbers to illegally transfer money from their accounts. Moreover, due to lack of awareness among customers and weak cyber security systems in Nepalese banks, the number of such financial crimes has been increasing rapidly.

3.Stiff competition

In the past there were very few banks and financial institutions and both banks and business operated in limited environment. But today the number of BFIs and business firms grown significantly. As a result, competition among them has become intense. Because of this, Nepalese banks are finding it difficult to attract customers and maintain stable profits. In order to compete, banks have begun providing various facilities and services including easy loan, interest rebate and customized offers to retain their customers. The increasing competition among BFIs has compelled them to provide better and more modern services. However, this competition has also created challenges such as low profit margins, risky lending practices and rising operational cost. To survive in such an environment, banks must develop strong policies, maintain efficiency and operate within ethical and regulatory boundaries. If banks fail to address these challenges properly, Nepal’s economic growth and banking stability could be negatively affected.

4.COVID 19 and Bank Performance

The economic crisis caused by the COVID-19 pandemic affected almost every sector of Nepal’s economy. During this time, Nepal Rastra Bank implemented several supportive monetary and other policies such as concessional loan and refinancing, to ease the financial burden on individuals and businesses. As a result, credit flow increased significantly in the fiscal year 078-79, leading to rapid growth in the loan portfolio.

However, many of these loans were utilized in unproductive or less productive sectors, creating a challenge for repayment. The post-pandemic slowdown in business activities, rising import cost and global economic uncertainties have increased the risk of non-performing loans(NPL). In this context it has become necessary to strengthen internal control mechanism, improve credit risk management and ensure the sustainability of the banking sector.

The banking sector has been intensely hit by the exogenous shock caused by the COVID-19 pandemic, that triggered a sharp decline in share prices. Furthermore, The financial landscape for Banks and Financial Institutions (BFIs) in Nepal has become increasingly challenging in recent years. While the COVID-19 pandemic severely disrupted global and local economies, Nepal Rastra Bank (NRB) – the country’s central bank – introduced a series of proactive and accommodative measures to safeguard the real economy; however, without providing direct relief or compensation to BFIs. Much of the financial and operational burden of these interventions was shouldered by the BFIs themselves, resulting in prolonged stress on their profitability, asset quality and overall financial health.

In order to mitigate the economic impact of COVID-19 during FY 2076/77, NRB mandated a 2% interest rebate for majority of the borrowers. NRB also retained a low Cash Reserve Ratio (CRR) of 3% to ensure liquidity through a circular on Baisakh 16, 2076. At the same time, BFIs were permitted to provide loans up to 100% of time deposits with a remaining tenure of two years or more, encouraging aggressive, deposit-backed lending practices. Although this provided short-term relief to affected businesses and individuals, BFIs had to absorb the loss, directly diminishing their interest income and poor assets quality. Relaxation given during pandemic period has been a big challenge for BFIs.

5.Loan Recovery Issues

Among the major problems and challenges faced by banking sector in Nepal, the issue of loan recovery is considered a significant one. The current situation of the economy after Gen-Z protest is in sluggish state. Because of this the borrower’s income generating activities have slowed down, resulting in declining in their repayment capacity. Consequently, the quality of loans has deteriorated. Banks have been facing increasing difficulties in the recovery of both principal and interest from borrowers. As a result, the number of non- performing loans has risen. This problem has been seen not only in commercial banks but also in development banks, finance companies, micro finance companies and cooperatives. Due to the lack of an effective loan recovery process, both the banks and government are suffering losses. As a result, the financial situation of banks has weakened. If such circumstances continue in the future, loan recovery will remain on of the hectic challenges for banks. Local government authorities are not supporting banks in process of recovery actions, that is also an area of concern too.

6.Technology Adoption

The competition among banks accentuates the necessity to implement AI technologies. Changes brought about by new players like Fintech companies require traditional banks to adopt AI in order to remain competitive in the marketplace. AI enables banks to improve customer service, enhance business processes, and develop new products. On the contrary, AI adoption comes with significant costs regarding data preparation, personnel training, and the technological infrastructure itself, which are challenging for resource-constrained banks to manage with aggressive competition within the industry, financial players have little choice but to embrace AI at an unprecedented pace, without which they will lose the market to other faster-adopting rivals.

Despite these obstacles to implementing AI in banking, there are enormous benefits to be gained, such as improved efficiency, enhanced customer experience, and increased security. Therefore, its implementation is imperative for the evolution of modern banking. To take these benefits, however, the banks must confront challenges in AI implementation, such as being technologically prepared, safeguarding privacy, dealing with sophisticated AI systems, and being affordable.

7. Lower investment in Productive Sector

The direction of a country’s economy can be understood by examining how banks and financial institutions allocate their credit whether toward consumption or productive sectors. The increasing demand of loans to import goods such as food items, clothing, vehicles, electrical appliances, smartphones and luxury products indicates that the economy is becoming more consumption oriented.

In contrast, sectors like agricultural production and export, hotel and restaurants, tourism related agro products, construction, handicrafts, production and export of goods, hydropower projects development and export of information technology related services have been relatively lower demand for loans. This suggests that the economy is becoming less production oriented.

Although the government/NRB has made some policy efforts to direct the economy toward productive activities, progress remains limited. According to the directives of Nepal Rastra Bank, banks are required to invest at least 15% of their loan portfolio in the agriculture sector, 10% in the energy sector and 15% in the SMEs sector. However due to various internal and external challenges, many Banks have struggled to fully comply with these directives.

Currently in Nepal, there is significant potential for investment in productive sectors such as agriculture, tourism, energy and IT. Yet, due to the lack of clear government policies, practical programs and physical infrastructure, it remains challenging for banks to sanction loan effectively and earn adequate returns in these areas.

Conclusion

The banking sector of Nepal is currently facing multiple internal and external challenges such as excessive liquidity pressure, lower interest rates, exchange rate instability, dangerous looking NPL level, problem of shadow banking, poor financial sector access especially in rural areas and the impact of global geopolitical and economic changes. Despite various efforts by the government and the Nepal Rastra Bank there has been a slowdown in credit demand and overall investment activities. Similarly, high competition, low return on equity, declining profit margin and stiff competition have also created difficulties for banks.

To address these challenges, it is essential to strengthen institutional governance, improve supervision and regulation, enhance risk management systems, promote transparency, and focus on productivity-oriented sectors. Likewise, continuous upgrading of banking technology, employee efficiency and financial discipline are vital for sustainable growth and stability. Sustainable and long-term development of Nepal’s banking sectors requires coordinated efforts among the government, Nepal Rastra Bank, BFIS, Employees, Entrepreneur, Customers and all other stakeholders.