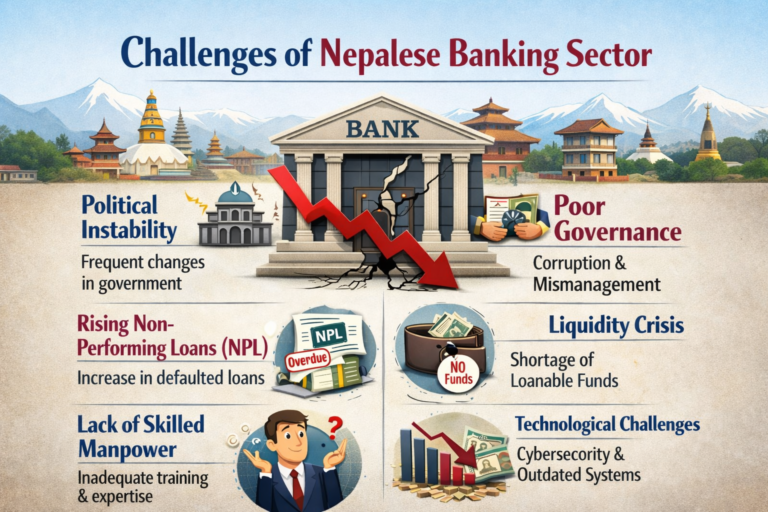

Context and Background

Banking sector plays a crucial role in economic development of a nation. The banking sector of Nepal has played a vital role in promoting financial inclusion, economic growth, industrialization and investment over the past decades. With the expansion of financial institutions and technological

Context and Background

Banking sector plays a crucial role in economic development of a nation. The banking sector of Nepal has played a vital role in promoting financial inclusion, economic growth, industrialization and investment over the past decades. With the expansion of financial institutions and technological

Introduction:

Financial sector reforms are the activities or initiatives taken by the government and central bank to make financial sector more efficient, inclusive and risk resilient. It is continuous process implemented in order to improve the quality of financial services and the functioning of financial system

Introduction:

Financial sector reforms are the activities or initiatives taken by the government and central bank to make financial sector more efficient, inclusive and risk resilient. It is continuous process implemented in order to improve the quality of financial services and the functioning of financial system

The banking sector plays an increasingly important role in the economy of a country. It is considered as a catalyst for the development of economy. Efficient and stable financial sector is prerequisite for sustainable economic development. Without efficient and stable financial sector economic development is

The banking sector plays an increasingly important role in the economy of a country. It is considered as a catalyst for the development of economy. Efficient and stable financial sector is prerequisite for sustainable economic development. Without efficient and stable financial sector economic development is

With the establishment of the Nepal Rastra Bank (NRB) in 1956 as the nation's central bank, Nepal's banking history got underway in the middle of the 20th century. In the 1950s and 1960s, early banks providing basic services such as Nepal Bank Limited and Rastriya

With the establishment of the Nepal Rastra Bank (NRB) in 1956 as the nation's central bank, Nepal's banking history got underway in the middle of the 20th century. In the 1950s and 1960s, early banks providing basic services such as Nepal Bank Limited and Rastriya

पृष्ठभूमी

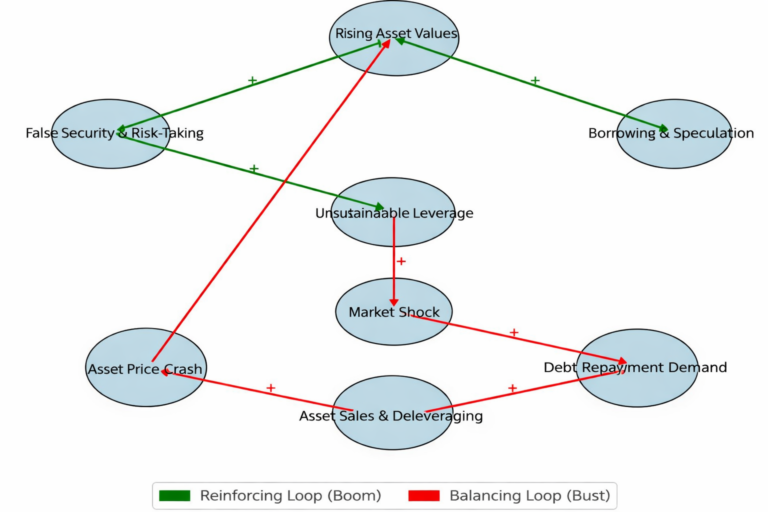

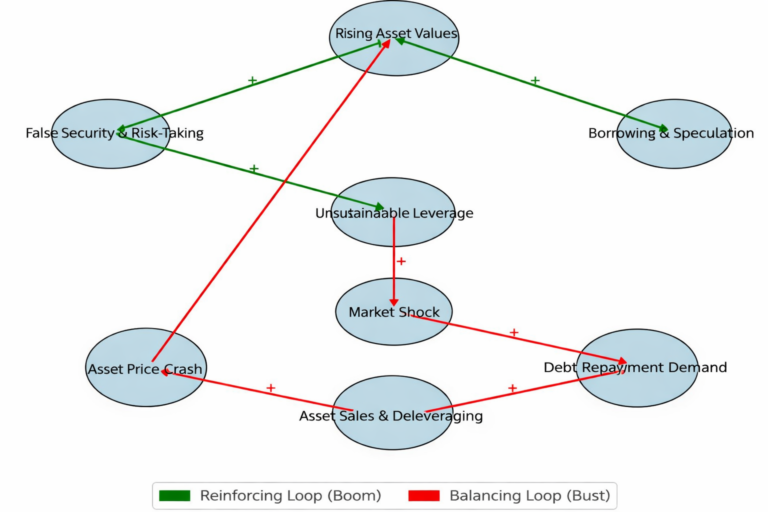

जसरी मौद्रिक नीति सम्वन्धी छलफलहरुमा व्याजदरको वहसले प्राथमिकता पाउने गरेको छ, कर्जा विस्तारको चर्चाले कम महत्व पाएको देखिन्छ । तर, सन १९३० को महामन्दी र त्यसपछिका विभिन्न घटनाक्रमहरुलाई समेत नियाल्ने हो भने कर्जा प्रवाह र वित्तीय स्थायित्वमा यस्को प्रभावका सम्वन्धमा थप स्पष्ट हुन्छ । यद्दयपी,

पृष्ठभूमी

जसरी मौद्रिक नीति सम्वन्धी छलफलहरुमा व्याजदरको वहसले प्राथमिकता पाउने गरेको छ, कर्जा विस्तारको चर्चाले कम महत्व पाएको देखिन्छ । तर, सन १९३० को महामन्दी र त्यसपछिका विभिन्न घटनाक्रमहरुलाई समेत नियाल्ने हो भने कर्जा प्रवाह र वित्तीय स्थायित्वमा यस्को प्रभावका सम्वन्धमा थप स्पष्ट हुन्छ । यद्दयपी,

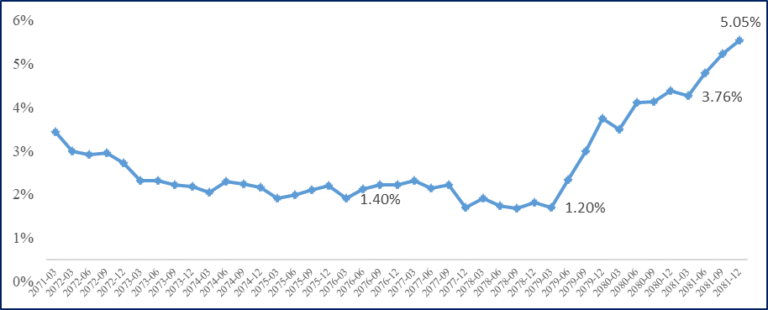

ऋण प्रवाह गर्दा तोकिएको शर्त वा अवधिभित्र उठ्न बाँकी साँवा तथा ब्याज असुल गर्ने प्रक्रियालाई कर्जा असुली भनिन्छ । जब ऋणीले समयमा कर्जाको साँवा ब्याज भुक्तान गर्न सक्दैन वा शर्त बमोजिम ऋणको सदुपयोग गर्दैन तब कर्जा असुली प्रक्रियाको शुरुवात हुन्छ अर्थात जब कर्जा लिँदाका वखत

ऋण प्रवाह गर्दा तोकिएको शर्त वा अवधिभित्र उठ्न बाँकी साँवा तथा ब्याज असुल गर्ने प्रक्रियालाई कर्जा असुली भनिन्छ । जब ऋणीले समयमा कर्जाको साँवा ब्याज भुक्तान गर्न सक्दैन वा शर्त बमोजिम ऋणको सदुपयोग गर्दैन तब कर्जा असुली प्रक्रियाको शुरुवात हुन्छ अर्थात जब कर्जा लिँदाका वखत

Bank Marketing Concept

The bank marketing is the practice of attracting and acquiring new customers through traditional media and digital media strategies. The use of these media strategies helps determine what kind of customer is attracted to a certain institution. This also includes different banking institutions

Bank Marketing Concept

The bank marketing is the practice of attracting and acquiring new customers through traditional media and digital media strategies. The use of these media strategies helps determine what kind of customer is attracted to a certain institution. This also includes different banking institutions

Abstract

Nepal's banking industry plays a vital role in supporting its developing economy. For years, it's been run through a centralized system led by the Nepal Rastra Bank (NRB), which oversees regulations, monitoring, and monetary strategies. This approach has had some real wins, like ensuring stability

Abstract

Nepal's banking industry plays a vital role in supporting its developing economy. For years, it's been run through a centralized system led by the Nepal Rastra Bank (NRB), which oversees regulations, monitoring, and monetary strategies. This approach has had some real wins, like ensuring stability

पृष्ठभूमि

सार्वजनिक संस्थाहरुले गर्ने खरिदलाई व्यवस्थित गर्न एउटा निश्चित विधि र प्रक्रिया अपनाइएको हुन्छ । नेपालमा संघीय, प्रादेशिक र स्थानिय सरकारी कार्यालयहरुले सार्वजनिक खरिद ऐन, २०६३ र सार्वजनिक खरिद विनियमावली, २०६४ बमोजिम सार्वजनिक खरिद प्रक्रिया अघि बढाउने गरेका छन् । नेपाल बैंकले सार्वजनिक खरिद ऐन, २०६३

पृष्ठभूमि

सार्वजनिक संस्थाहरुले गर्ने खरिदलाई व्यवस्थित गर्न एउटा निश्चित विधि र प्रक्रिया अपनाइएको हुन्छ । नेपालमा संघीय, प्रादेशिक र स्थानिय सरकारी कार्यालयहरुले सार्वजनिक खरिद ऐन, २०६३ र सार्वजनिक खरिद विनियमावली, २०६४ बमोजिम सार्वजनिक खरिद प्रक्रिया अघि बढाउने गरेका छन् । नेपाल बैंकले सार्वजनिक खरिद ऐन, २०६३

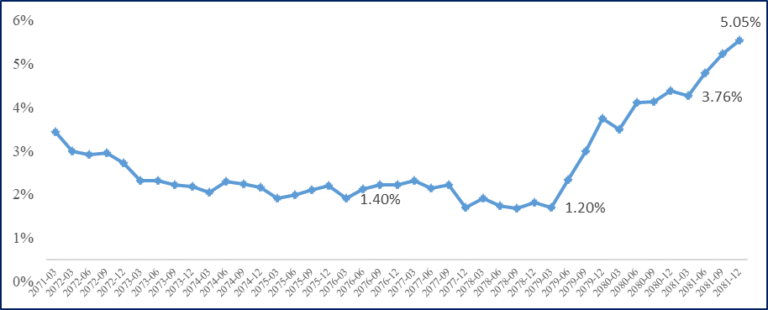

Financial indicators of the banks and financial institutions have been impacted by the slowdown in economic activities in the post-COVID period, amid difficult global as well as domestic economic conditions. On the global scale, geopolitical tensions have impacted global economic and financial conditions while slowdown

Financial indicators of the banks and financial institutions have been impacted by the slowdown in economic activities in the post-COVID period, amid difficult global as well as domestic economic conditions. On the global scale, geopolitical tensions have impacted global economic and financial conditions while slowdown

Context and Background

Banking sector plays a crucial role in economic development of a nation. The banking sector of Nepal has played a vital role in promoting financial inclusion, economic growth, industrialization and investment over the past decades. With the expansion of financial institutions and technological

Context and Background

Banking sector plays a crucial role in economic development of a nation. The banking sector of Nepal has played a vital role in promoting financial inclusion, economic growth, industrialization and investment over the past decades. With the expansion of financial institutions and technological