Assets (Money) Laundering

Introduction:

The process, ways and activities of changing black money or assets in to white is called money laundering. This act is strictly prohibited all over the world taking it as a serious financial crime that also falls under the headings of an organized crime. Money laundering is the process of concealing illicit sources of money. It is an act of engaging in financial transactions to conceal the identity, source or destination of illegally-earned money1.

Money laundering creates distortion in the economy. It criminalizes the financial and economic activities creating an organized underworld and unofficial or informal economy, reduces incentives for investment, spoils financial discipline and distorts political and other socio-economic systems.

Basically, the illegal sources of property or assets includes: money earned from corruption, drugs trafficking, human trafficking, illegal trade of weapons, illicit money earned from terrorism, money earned from smuggling, and money earned from other criminal activities such as abduction, forced contribution, robbery, theft, etc.

Money laundering is a scheme whereby the proceeds of an illegal activity are transacted and made to appear to have originated from legitimate source. Similarly, this can be said as the processing of criminal proceeds to disguise their illegal origin in order to “legitimize” the ill-gotten gains of crime.

Money laundering is the process by which illegally obtained funds are given the appearance of having been legitimately obtained. It is a process of converting cash or property derived from criminal activities to give it a legitimate appearance. It is a process to clean ‘dirty money’ in order to disguise its criminal origin. The sources of dirty money consist of illegal drugs trade, illegal arms and ammunitions trade, illegal income from prostitution, human trafficking related proceeds, illicit money earned from corruption, forgery, smuggling, revenue related crimes and other organized crimes.

The prevailing “Asset (Money) Laundering Prevention Act, 2008” has clearly stated the offences of money laundering on Chapter-2, Section 3 to 5. The term transactions as defined in law covers any act or agreement made in order to carry out any economic or business transactions and the term also denotes the transactions including acquisition, sale, distribution, transfer, or investment and possession of any assets by any means. The Act has provisioned different important subject matter to prevent laundering of criminally earned assets.

To prevent the act of money laundering, the prevailing law relating to prevent money laundering has clearly explained about the liability of government entity, bank, financial institution and non-financial institution.

Methods of Money Laundering:

The fundamental methods employed for money laundering are:

- Structuring – Illicit money is fragmented in to smaller transactions and deposited in to banks in various places, in other person’s account.

- Bulk cash smuggling – Investing, depositing in to banks to smuggle cash in other countries.

- Trade-based money laundering – Illicit money showing as income from trade and business.

- Real estate – Investing in real estate to show illicit money as profit earned through capital gain.

- Casinos – Concealing illicit money as earned by gambling in casinos.

Steps or Methods of Money Laundering

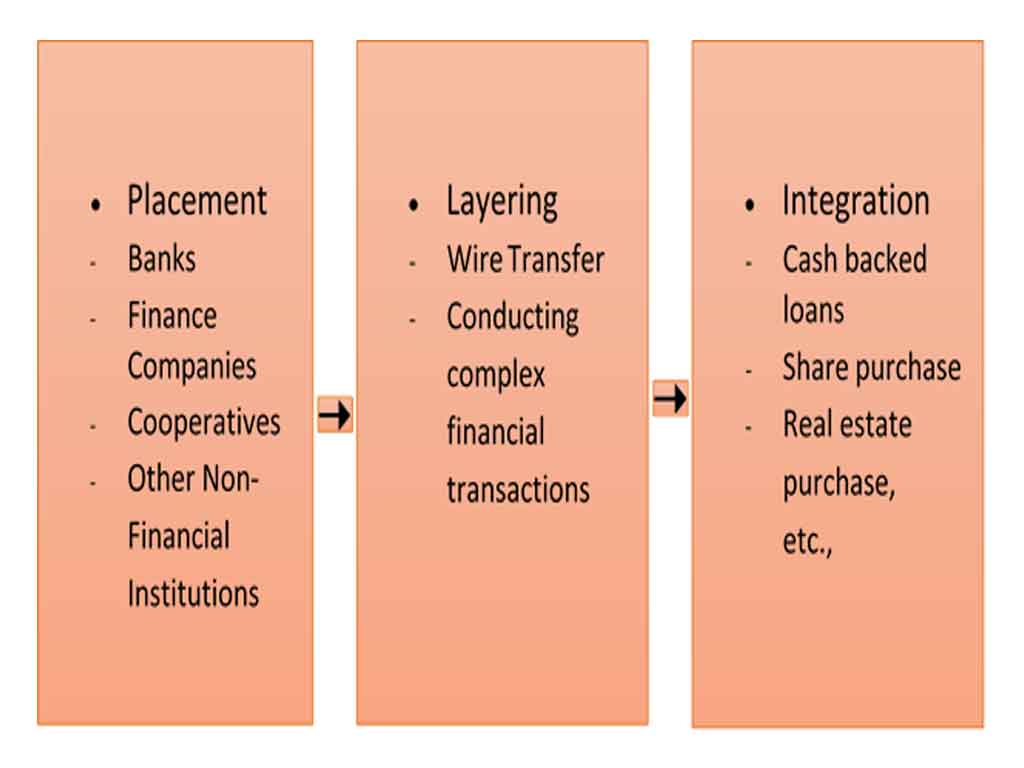

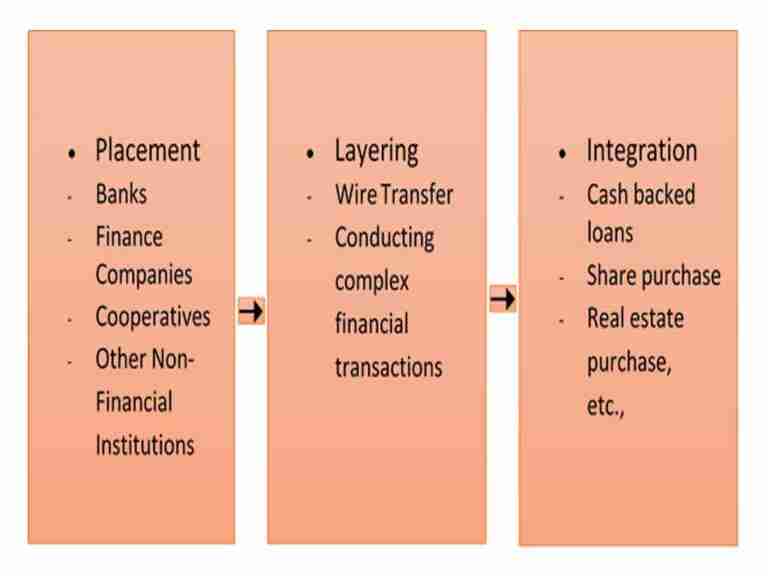

The steps or methods of money laundering can be further explained as under:

- Placement: Cash is introduced in the system.

- Layering: Carry out complex financial transactions to make illegal proceeds legal.

- Integration: Acquiring wealth generated from illicit transactions.

Money laundering refers to the concealment, conversion, or disguise of money or property owned through illegal means and making it legal by using official channels such as financial institutions and non- financial institutions. Money laundering and the ‘Terrorist Financing’ are the interrelated organized crimes. The United Nations Convention against Transnational Organized Crime, 2000 defines money laundering as concealing or disguising illicit money or property or support for it or owns it. However, both concepts are interconnected despite their distinctive feature and methods and are associated with transnational organized crime.

History of Money Laundering:

The history of money laundering was ancient in nature, though this concept is apparently new from regulatory perspective. The offshore method was used in the proceeds generated from the crime in China to transfer from one place to another especially to the remote province of China or outside of it in 3000 BC.2 Then gold coins were used for hiding proceeds of crime as it is easier to change its shape.

The money laundering is believed to be originated in the United States in the 1920s. Criminal gangs themselves involved to hide the proceeds of their criminal efforts. They tried to misuse high turnover business like launderettes and car washes. They started to mingle the nefarious/ evil or wicked cash with legitimate income to create licit business income. ‘Whilst the term ‘laundering’ is today stressed for the world’s association with washing and cleaning, the original criminal link was because of the use of laundering businesses.3

In the context of money laundering, mafia, gangster, and pirate started to transfer their illegal money in to legal one by using various methods. During the time of insurgency and international war, there may be huge possibility of money laundering. During World War II, many German authorities were blamed for participating in money laundering related activities. By abusing their power of authority, they bribed or taken huge amount of ransom/payment and transferred it into valid income.

Provisions for Controlling Money Laundering in Nepal:

- Assets (Money) Laundering Prevention Act, 2064 has been enacted which makes legal provisions regarding money laundering prevention in Nepal.

- Establishment of Department of Money Laundering Investigation in 2068 B.S.

- Nepal has expressed commitment to collaborate and coordinate in global networking on issues of money laundering.

- There is Financial Information/Intelligence Unit (FIU), in Nepal Rastra Bank, the central bank of Nepal.

- Money laundering and investment in terrorist activities control strategy and action plan 2068-2073 were enforced.

- National coordination committee relating to money laundering prevention coordinated by Finance Secretary.

- “Special Court” adjudicates the cases related to money laundering.

- Vigilance in financial transactions and “Know Your Customer” KYC system adopted in many banks and financial institution, insurance companies, cooperatives and other many more financial and non-financial institutions.

- Use of “go AML Software” in AML related reporting as designed and developed by the UNODC (United Nations Office on Drugs and Crimes) for banking and financial sectors.

- Unified Directives (Directive No.19) for banks and financial institutions.

- Directives issued by Insurance Board.

- Directives and circulars issued by the Securities Board of Nepal (SEBON).

- Other laws, policies, guidelines and circulars relating to financial institutions and the non-bank financial institutions and, designated non-financial business and profession.

Stakeholders in Anti-Money Laundering / Combating Financing of Terrorism:

The important stakeholders among all stakeholders relating to AML/CFT can be explained as under:

- Reporting entities,

- Regulators and supervisors,

- FIU Nepal,

- Implementation committee,

- The ‘Mutual Legal Assistance (MLA) authority’,

- Prosecution related body,

- Judicial bodies,

- National coordination committee,

- Law enforcement agencies.

Legal Instruments Against Money Laundering:

The major legal instruments against money laundering can be written as under:

- Assets (Money) Laundering Prevention Act, 2008,

- FATF revised and updated 40 recommendations,

- Assets (Money) Laundering Prevention Rules,2016,

- Unified Directives issued by NRB towards banks and financial institutions,

- Directives issued by the Insurance Board towards the insurance companies,

- Mutual Legal Assistance Act,2014,

- Extradition Act, 2014,

- Organized Crime Prevention Act, 2014,

- Confiscation of Criminal Proceeds Act, 2014,

- Control of Corruption Act, 2002

- UNSCRs Rules, 2013,

- Mutual Legal Assistance Rules, 2014,

- Other laws relating to prevention of ‘money-laundering’ and the ‘financing of terrorism’.

Reporting Entities Relating to Prevention of Money Laundering in Nepal:

There are many reporting entities in Nepal regarding the subject areas of prevention of money laundering. As per the Assets (Money) Laundering Prevention Act,2008 reporting entity includes financial institutions, non-financial institutions, designated non- financial business and professions. ‘National Strategy and Action Plan’ relating to Money Laundering and Terrorism Financing (2019-2024) has also clearly defined the reporting entities and their regulators. They are:

| S.N | Institutions/ Body | Regulators |

|---|---|---|

| Financial Institutions | ||

| 1 | Bank and Financial Institutions | Nepal Rastra Bank |

| 2 | Money Remitter | Nepal Rastra Bank |

| 3 | Money Changer | Nepal Rastra Bank |

| 4 | Securities Companies | SEBON |

| 5 | Insurance Companies | Insurance Board |

| 6 | Cooperatives | Department of Cooperatives |

| 7 | Approved Retirement Fund | Inland Revenue Department |

| 8 | Non-Bank Financial Institutions (Employee Provident Fund, Citizen Investment Trust, Postal Bank) | Nepal Rastra Bank |

| Designated Non-Financial Business and Profession: | ||

| 9 | Real Estate Business / Agents | Department of Land Management and Archive |

| 10 | Trust and Company Service Providers | Company Registrar’s Office |

| 11 | Casinos or Internet Casino Business | Ministry of Culture, Tourism and Civil Aviation |

| 12 | Dealers in Precious Stones and Metals | Inland Revenue Department |

| 13 | Auditors and Accountants | Institute of Chartered Accountants of Nepal (ICAN) |

| 14 | Notary Public | Notary Public Council |

| 15 | Law Practitioners | Nepal Bar Council |

Similarly, the law enforcement agencies such as: Department of Money Laundering Investigation (DMLI), Nepal Police, Commission for the Investigation of the Abuse of Authority (CIAA), Department of Revenue Investigation (DRI), Inland Revenue Department (IRD) are playing great role to prevent the money laundering related activities. And, regulators and supervisors such as: Nepal Rastra Bank (NRB), Securities Board of Nepal (SEBON), Insurance Board (IB), Department of Cooperatives, Ministry of Culture, Tourism and Civil Aviation, Department of Land Management and Archive, Notary Public Council, The Institute of Chartered Accountants of Nepal (ICAN), Office of the Company Registrar’s and Nepal Bar Council are also playing vital role to prevent the money laundering related activities in Nepal.4

International Cooperation and Engagement:

The international engagements and cooperation regarding the prevention of money laundering or anti-money laundering are as follows:

- Asia / Pacific Group on Money Laundering (APG)

- Financial Action Task Force (FATF) – Established in July 1989

- Egmont Group of FIUs

- Memorandum of Understanding with Foreign FIUs

- Cooperation and exchange of Information with FIUs.

Palermo Convention, 2000 and Money Laundering:

The convention named “United Nations Convention Against Transnational Organized Crime” signed in Palermo, Italy, in December 2000, was the international milestone to combat with transnational organized crime. This convention is called ‘Palermo Convention,2000 in short for the purpose of understanding it in a simple way.

With the signing of the United Nations Convention against Transnational Organized Crime in Palermo, Italy, in December 2000, the international community demonstrated the political will to answer a global challenge with a global response. The convention gives us a new tool to address the scourge of crime as a global problem. The signing of the convention was a watershed event in the reinforcement of the fight against organized crime.

The United Nations Convention against Transnational Organized Crime, Article-6, and Article-7 is related to the subject matters relating to “Money Laundering”. The subject matters as covered in these articles are written as under:

Article-6: Criminalization of the laundering of proceeds of crime

- Each State Party shall adopt, in accordance with fundamental principles of its domestic law, such legislative and other measures as may be necessary to establish as criminal offences, when committed intentionally:

- a) i) The conversion or transfer of property, knowing that such property is the proceeds of crime, for the purpose of concealing or disguising the illicit origin of the property or of helping any person who is involved in the commission of the predicate offense to evade the legal consequences of his or her action;

ii) The concealment or disguise of the true nature, source, location, disposition, movement or ownership of or rights with respect to property, knowing that such property is the proceeds of crime; - b) Subject to the basic concepts of its legal system:

i) The acquisition, possession or use of property, knowing, at the time of receipt, that such property is the proceeds of crime;

ii) Participation in, association with or conspiracy to commit, attempts to commit and aiding, abetting, facilitating and counselling the commission of any of the offenses established in accordance with this article.

- a) i) The conversion or transfer of property, knowing that such property is the proceeds of crime, for the purpose of concealing or disguising the illicit origin of the property or of helping any person who is involved in the commission of the predicate offense to evade the legal consequences of his or her action;

- For purposes of implementing or applying paragraph 1 of this article:

- a) Each State Party shall seek to apply paragraph 1 of this article to the widest range of predicate offences;

b) Each State Party shall include as predicate offenses all serious crime as defined in article 2 of this Convention and the offenses established in article 5, 8 and 235 of this Convention. In the case of States Parties whose legislation sets out a list of specific predicate offenses, they shall, at a minimum, include in such list a comprehensive range of offenses associated with organized criminal groups;

c) For the purposes of paragraph (b), predicate offenses shall include offenses committed both within and outside the jurisdiction of the State Party in question. However, offenses committed outside the jurisdiction of a State Party shall constitute predicate offenses only when the relevant conduct is a criminal offense under the domestic law of the State where it is committed and would be a criminal offense under the domestic law of the State Party implementing or applying this article had it been committed there;

d) Each State Party shall furnish copies of its laws that give effect to this article and of any subsequent changes to such laws or a description thereof to the Secretary General of the United Nations;

e) If required by fundamental principles of the domestic law of a State Party, it may be provided that the offences set forth in paragraph 1 of this article do not apply to the persons who committed the predicate offense;

f) Knowledge, intent or purpose required as an element of an offense set forth in paragraph 1 of this article may be inferred from objective factual circumstances.

- a) Each State Party shall seek to apply paragraph 1 of this article to the widest range of predicate offences;

Article-7: Measures to combat money laundering

- Each State Party:

a) Shall institute a comprehensive domestic regulatory and supervisory regime for banks and non-bank financial institutions and, where appropriate, other bodies particularly susceptible to money-laundering, within its competence, in order to deter and detect all forms of money-laundering, which regime shall emphasize requirements for customer identification, record-keeping and the reporting of suspicious transactions;

b) Shall, without prejudice to article 18 and 276 of this Convention, ensure that administrative, regulatory, law enforcement and other authorities dedicated to combating money-laundering (including, where appropriate under domestic law, judicial authorities) have the ability to cooperate and exchange information at the national and international levels within the conditioned prescribed by its domestic law and, to that end, shall consider the establishment of a financial intelligence unit to serve as a national center for the collection, analysis and dissemination of information regarding potential money-laundering. - States Parties shall consider implementing feasible measures to detect and monitor the movement of cash and appropriate negotiable instruments across their borders, subject to safeguards to ensure proper use of information and without impeding in any way the movement of legitimate capital. Such measures may include a requirement that individuals and businesses report the cross- border transfer of substantial quantities of cash and appropriate negotiable instruments.

- In establishing a domestic regulatory and supervisory regime under the terms of this article, and without prejudice to any other article of this Convention, States Parties are called upon to use as a guideline the relevant initiatives of regional, interregional and multilateral organizations against money-laundering.

- States Parties shall endeavor to develop and promote global, regional, sub- regional and bilateral cooperation among judicial, law enforcement and financial regulatory authorities in order to combat money-laundering.

Why do Criminals Launder the Money?

The criminals want to launder the money because of following mentioned reasons:

- Hiding the wealth,

- Avoiding the prosecution,

- Evading the taxes,

- Increasing the profits,

- Becoming legitimate, etc.

In Nepal, the prevailing laws relating to the prevention of money laundering has criminalized different offences as an act of money laundering and the terrorism financing. The Chapter 7 of the Assets (Money) Laundering Prevention Act, 2008 has clearly explained about the different relevant punishments towards the money launderer in Nepal.

Problems Relating to Money Laundering in Nepal:

The problems of money-laundering are spreading all over the world due to globalization of economic activities. Nepal has adopted many legal, institutional and international best practices to combat with the activities of money-laundering and the terrorism financing. Nepal has made legal and institutional provisions regarding the control of money- laundering. However, she is facing various problems on her journey to efficiently and effectively combat it. Some of the most apparent problems are:

- Political protection to those involved in money laundering,

- Weak institutional capacity and intelligence strength to investigate and take action against money laundering,

- Political instability hampering the formulation of required policies, and frequent policy changes.

- In effective border surveillance and regulation, and increasing cross border crime,

- Weak oversight mechanism and vigilance in financial institutions,

- Behavioral apathy to rule of law, and prevalence of impunity,

- Low level of public awareness and inactive civil society concerning money- laundering,

- Criminalization of politics and politicization of crime is trending.

Thus, all these are the major problems associated with the money-laundering in Nepal.

Conclusion:

Criminal activities such as drugs trafficking, smuggling, human trafficking, corruption and others, tend to generate large amounts of profits for the individuals or groups carrying out the criminal act. However, by using funds from such illicit sources, criminals risk drawing the authorities’ attention to the underlying criminal activity and exposing themselves to criminal prosecution. In order to benefit freely from the proceeds of their crime, they must therefore conceal the illicit origin of these funds. Briefly described, “money-laundering” is the process by which proceeds from a criminal activity are disguised to conceal their illicit origin. It may encompass: the conversion or transfer, knowing that such property is the proceeds of crime, the concealment or disguise of the nature, source, location, disposition, movement or ownership of or rights with respect to property, knowing that such property is the proceeds of crime, and the acquisition, possession or use of property, knowing at the time of the receipt, that such property is the proceeds of crime. The international Convention named “United Nations Convention against Transnational Organized Crime, 2000” is an important tool that works on the prevention and combating the money-laundering and financing of terrorism related crimes. This Convention is also termed as ‘Palermo Convention’ because it was signed in Palermo, Italy in December 2000.

References

- Harish Chandra Singh Thakuri, Governance System and Contemporary Issues, Ashish Book House, Kathmandu,2021, p.235.

- Suman Acharya, Nepal Rastra Bank Samachar, Kathmandu, 2073, p.240.

- Peter Lilley, Dirty Dealing, 3rd ed., Kogan Page Limited, London and Philadelphia, 2006, p.5.

- Financial Information Unit, Annual Report 2019/20, Kathmandu, 2020, p.13.

- Article-5. Criminalization of participation in an organized criminal group. Article-8. Criminalization of Corruption. Article-23. Criminalization of obstruction of justice.

- Article-18 Mutual legal assistance. Article-27 Law enforcement cooperation.